Prime Day 2025: Retail Winners, Losers, and Key Insights for Q4

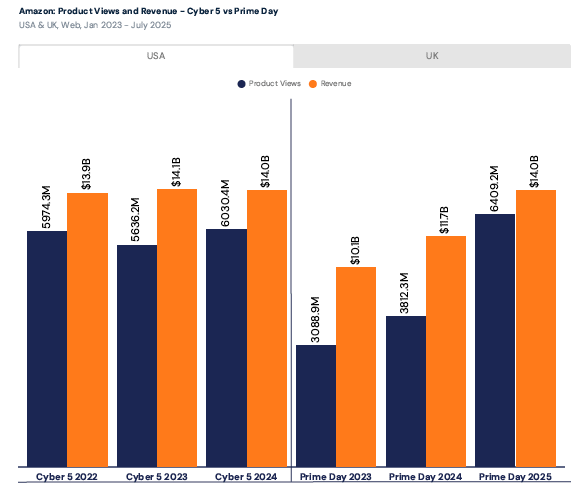

It is now both a retail event and a crystal ball for Q4 – Prime Day 2025 matched Cyber 5 revenue, hitting $14 billion in US sales.

Amazon’s four-day shopping spree has arguably reshaped the mid-year calendar, going well beyond its traditional scope to grab consumer attention.

But other retailers also reaped rewards.

Understanding the winners and losers from Prime Day reveals critical insights for retailers preparing for peak shopping months.

Here we examine what brands nailed it or stumbled, and what you can learn for Q4. And if you’re interested in the bigger picture, look no further than our comprehensive Prime Day report.

Amazon’s big win and what it means

Amazon transformed Prime Day from a summer sales spike into a critical retail benchmark.

For the first time, the event stretched over four days, significantly changing how consumers approached their shopping.

Shoppers took their time, carefully researching deals from day one. They revisited offers throughout the event to ensure the best value.

A mid-year rival to Black Friday and Cyber Monday

Amazon captured $14 billion in revenue, equaling the commercial impact of the Q4 Cyber 5 sales period. Prime Day is now officially a mid-year rival to Black Friday and Cyber Monday.

This longer format provided brands with deeper insights into consumer trends and preferences ahead of the holiday season.

Retailers paying close attention saw clear signals of which products will perform best in Q4. Prime Day now shapes strategic planning for the holidays and sales throughout the year.

Retailers who benefited from Amazon’s halo

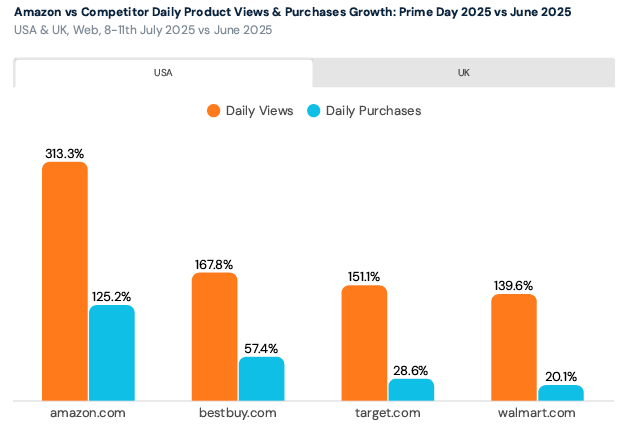

Amazon drove record-breaking numbers, but other retailers also cashed in. Walmart, Target, and Best Buy emerged as clear winners, especially in the US.

Walmart and Target captured meaningful increases in web and app traffic, thanks to their strategic positioning. Even with minimal paid advertising, they benefited from organic traffic spilling over from Amazon’s event.

Best Buy took a different route and launched its own “Black Friday in July” campaign just ahead of Prime Day. This tactic helped it gain significant ground in consumer electronics, capturing early demand for popular products like Apple’s AirPods Pro 2.

Loyalty programs, exclusive deals, and hybrid shopping options

Retailers succeeded by clearly differentiating their offers from Amazon’s. Loyalty programs, exclusive deals, and hybrid shopping options, such as in-store pickup, made them attractive alternatives to the retail giant.

These strategies helped successful brands capture short-term sales and gather important insights into customer preferences heading into the holiday season.

Retailers that paid attention during Prime Day gained valuable knowledge. They now have a clear picture of what resonates with consumers, providing an edge for upcoming Q4 promotions.

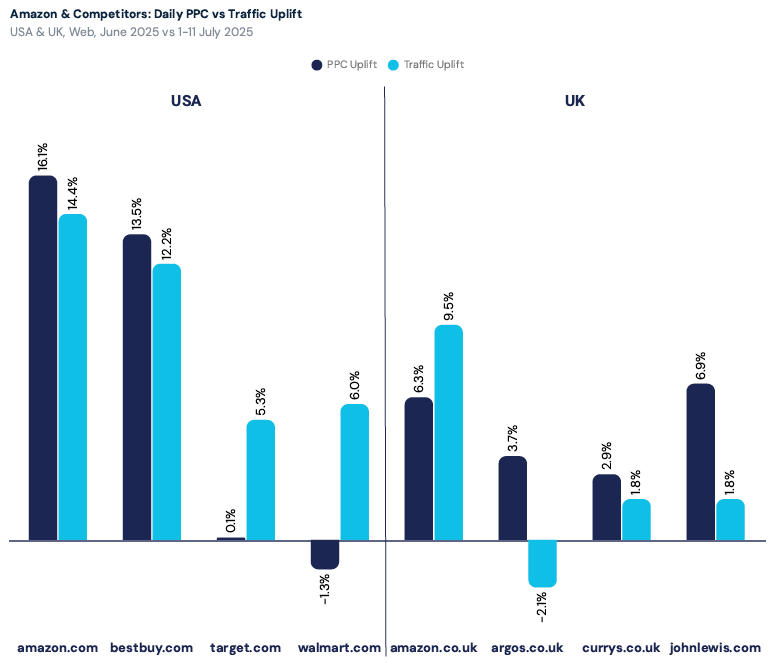

UK retailers left opportunities on the table

In the UK, Amazon dominated Prime Day while competitors struggled. Retailers like Argos and Currys boosted their paid advertising but saw limited gains or even declines in traffic.

UK shoppers were ready to spend, but didn’t look beyond Amazon. Competitors missed a chance by relying too heavily on advertising without clear differentiation or standout deals.

Spending more on advertising is not enough

Unlike their US counterparts, UK retailers offered few compelling alternatives. This oversight kept consumers focused on Amazon, limiting the success of competitors.

The lesson from the UK is clear. Simply spending more on advertising is not enough. Retailers must offer clear, targeted reasons to attract shoppers.

As retailers prepare for Q4, the message is simple: find unique ways to stand apart. Otherwise, spending big on ads might only help Amazon.

Shopper behavior is shifting

Prime Day revealed a major shift in consumer behavior. Shoppers carefully planned their purchases, moving toward deliberate buying rather than impulse shopping.

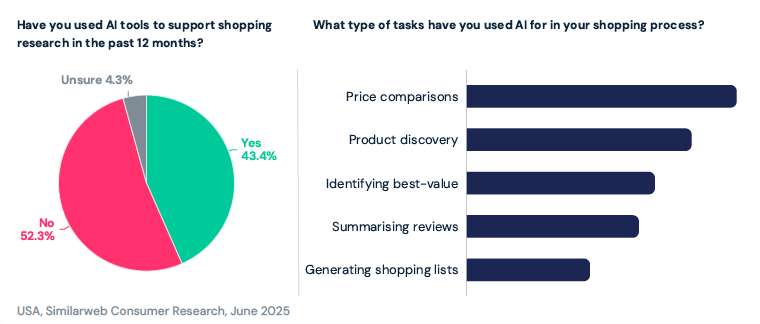

Consumers spent significant time researching products, comparing prices, and validating their choices. They used multiple tools, including social media, price comparison sites, and increasingly, generative AI.

Nearly 60% of shoppers said they might or would use AI to guide their decisions during Prime Day. AI-assisted shopping is becoming central to the consumer journey, especially among younger, digitally-savvy customers.

Retailers should ensure visibility across digital platforms

Brands that want to succeed during the holidays must adapt to this evolving landscape. Retailers should ensure visibility across digital platforms, optimize for AI-driven search, and provide clear, easy-to-find product details.

Understanding this shift is critical. Consumers now expect a thoughtful shopping experience that empowers their decisions. Brands that deliver this confidence will win loyalty and sales in Q4.

Critical insights for the coming holiday season

Prime Day 2025 revealed critical insights for the coming holiday season. Brands that thrived offered targeted promotions, clear differentiation, and intuitive shopping experiences. Those who overlooked these opportunities risked falling behind.

Retailers now have the tools to understand exactly what consumers want. Strategic planning, category-specific offers, and leveraging emerging technologies like AI are crucial for success this Q4.

Prime Day is more valuable than ever as an indicator of future retail trends. Use these insights to refine your strategies and position your brand to win during the holidays.

Click here to download our full Prime Day report.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!